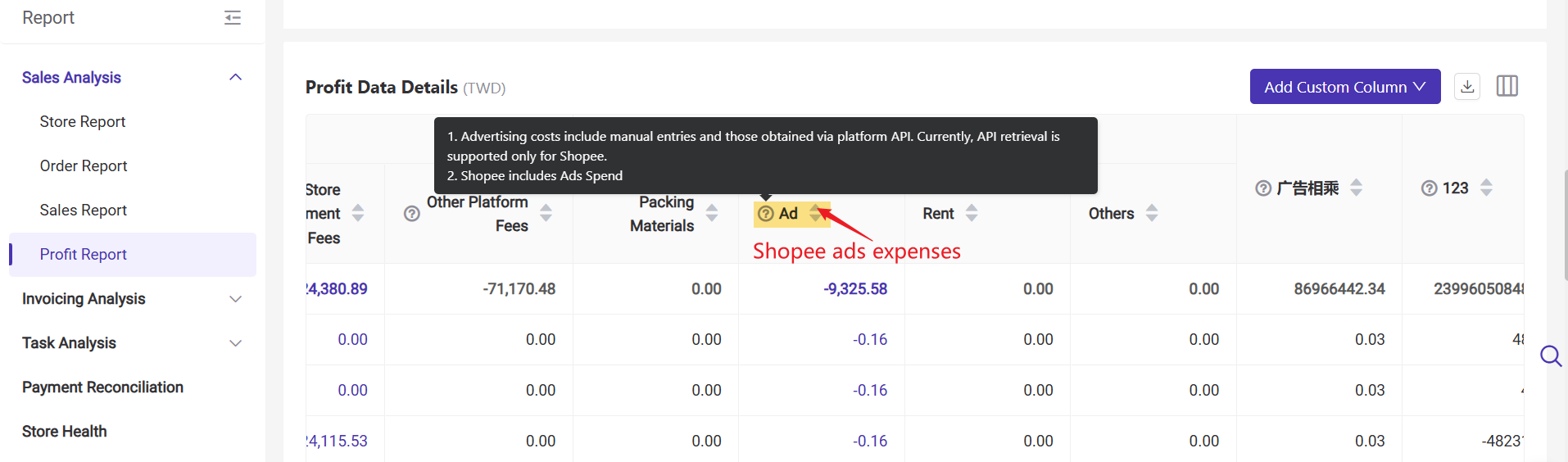

Note: From now, BigSeller will automatically fetch historical ads fee for your Shopee store. To avoid duplication, please do not manually add Shopee ad expenses under Other Fees.

For Shopee GMV max ads expenses, data or will be synchronized and updated on a dalily basis. The data of the current day will be visible on the next day.

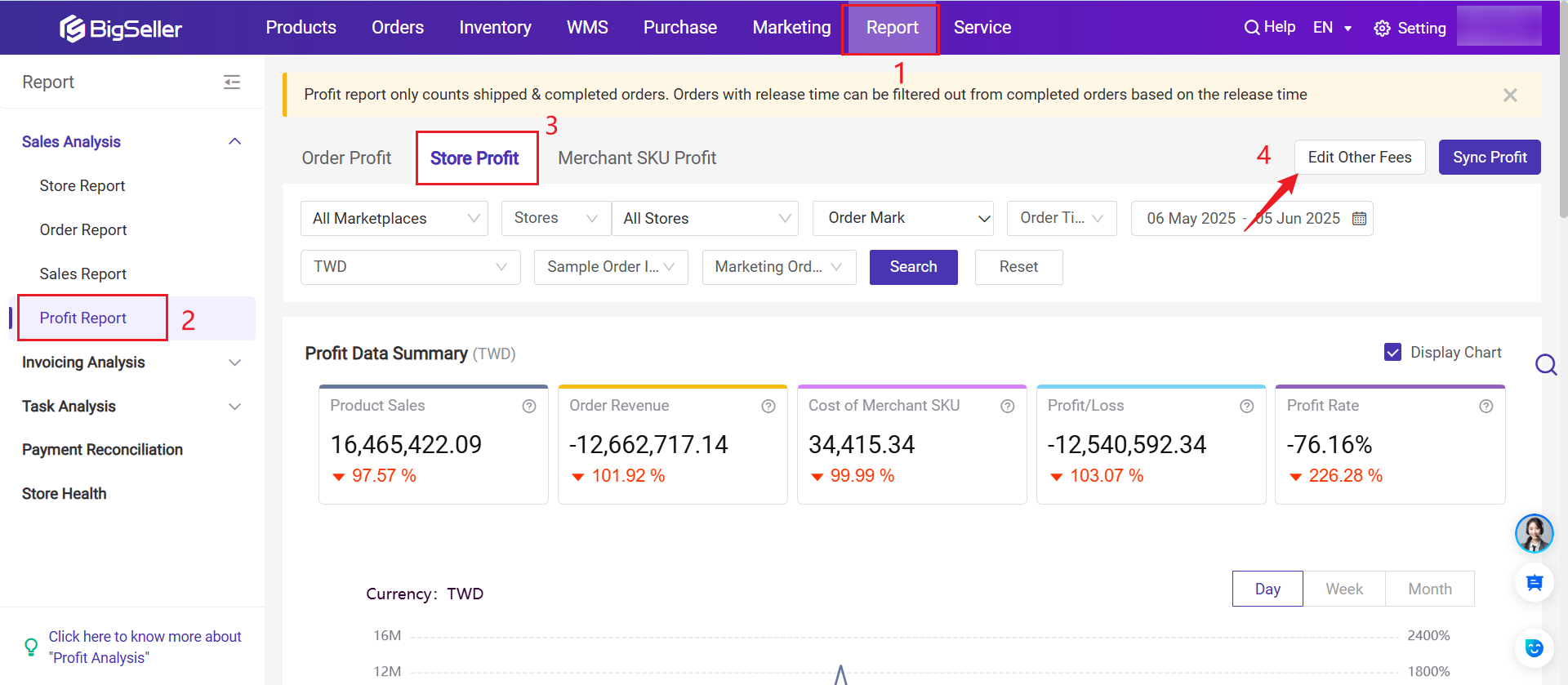

Steps

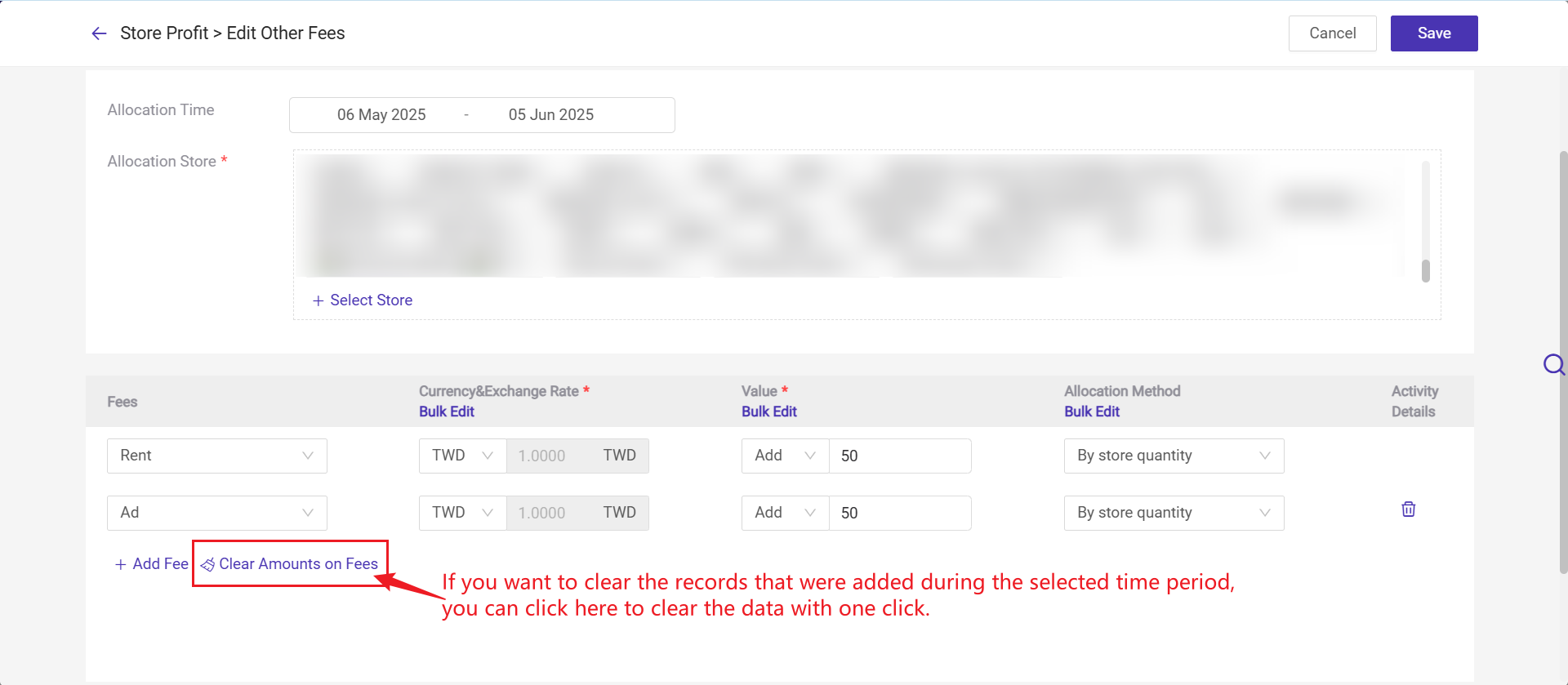

Step 1: Go to Report > Profit Analysis > Store Profit > Edit Other Fees

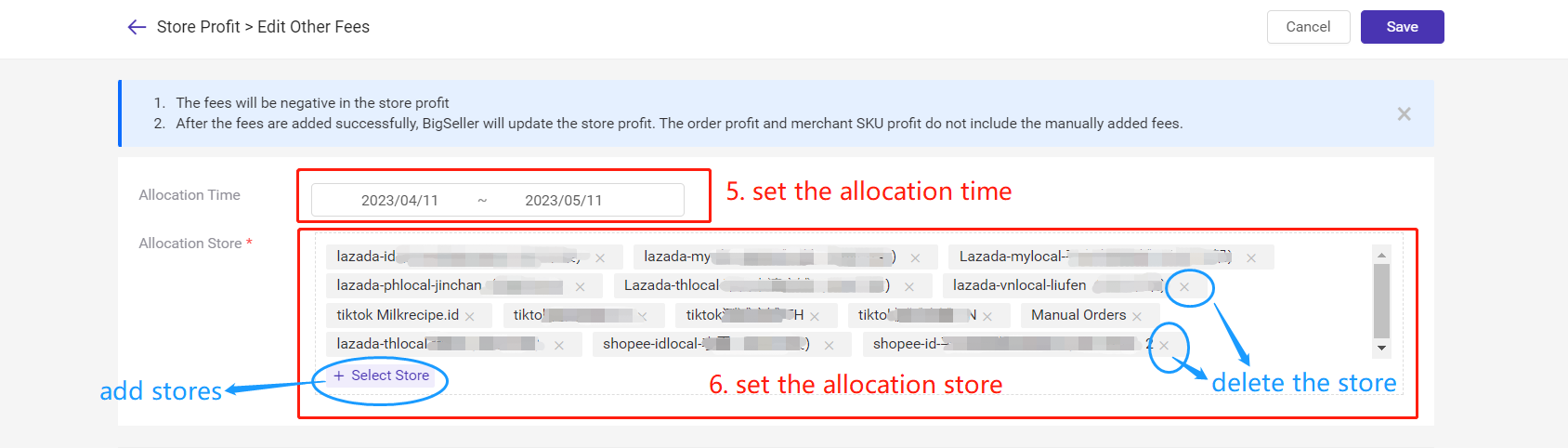

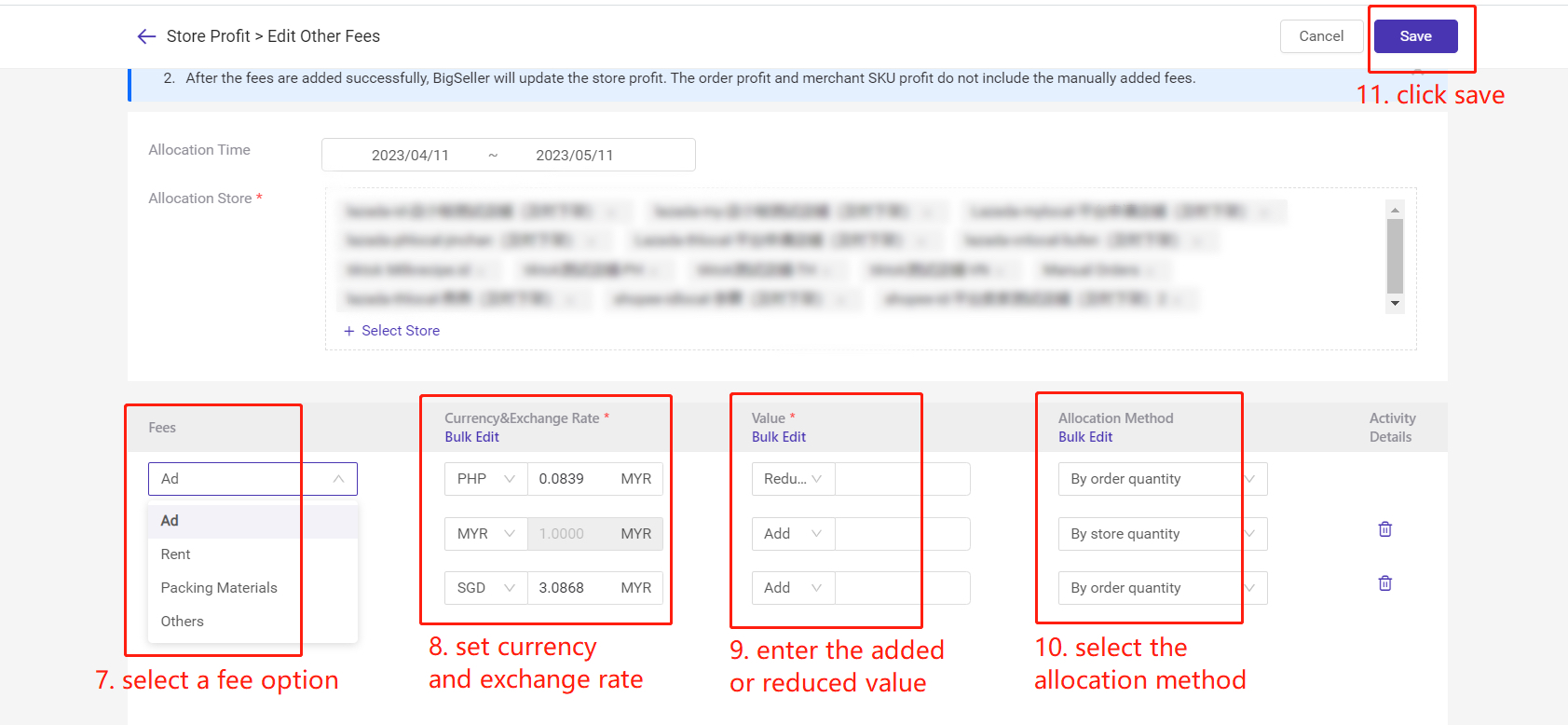

Step 2: Set the allocation time and store > select fees and enter the value > set allocation method

5. Allocation Time: The system defaults to selecting the last 30 days, and up to 90 days can be selected. The earliest available time is the day when the profit analysis feature was launched (2021-12-24);

6. Allocation Store: The system would add all stores with permission for this account by default, and you can select or delete store by yourself;

7. Fees: You can select advertising, rent, packing materials and other expenses;

8. Currency&Exchange Rate: The default is the current account region, and the exchange rate cannot be changed; You can manually change to another currency, and BigSeller will automatically retrieve the exchange rate for the day. You can also manually change it;

9. Value: Enter the corresponding fee amount;

10. Allocation Method: You can select to allocate by store quantity or order quantity.

- By Store Quantity: The fee would be allocated to each store based on the number of stores, and then for each store to each day based on the date.

Daily allocation fee for each store = Value/Store Quantity/Allocation Days

- By Order Quantity: The fee would be allocated based on the daily order volume of each store.

Daily allocation fee for each store = Order quantity in the store on the same day/Total orders within the selected time range * Fee.

Notes

1. When you select to allocate by order quantity, if the order quantity is 0 for all the stores, system would allocate the fee by store quantity.

2. When the fee cannot be fully divided, round them to two decimal places, and the allocation fee for the last store = Total Fee - Allocated Fee.

E.g. Fee 100 MYR for three stores in one day, allocation fee for the first two stores is 33.33 MYR, for the third store is 100-33.33*2 = 33.34 MYR

Fee 200 MYR for three stores in one day, allocation fee for the first two stores is 66.67 MYR, for the third store is 200-66.67*2 = 66.66 MYR